2025 Max 401 Contribution

2025 Max 401 Contribution. Log in to your principal account to check. Your contributions also can’t exceed 100% of your total salary.

For 2025, irs set the 401 (k) contribution limit to $22,500, reflecting an increase of $1,000 from 2025.

The IRS just announced the 2025 401(k) and IRA contribution limits, You will be able to contribute an additional $500 in 2025. The 401 (k) overall contribution limit in.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, You will be able to contribute an additional $500 in 2025. Employers can contribute to employee.

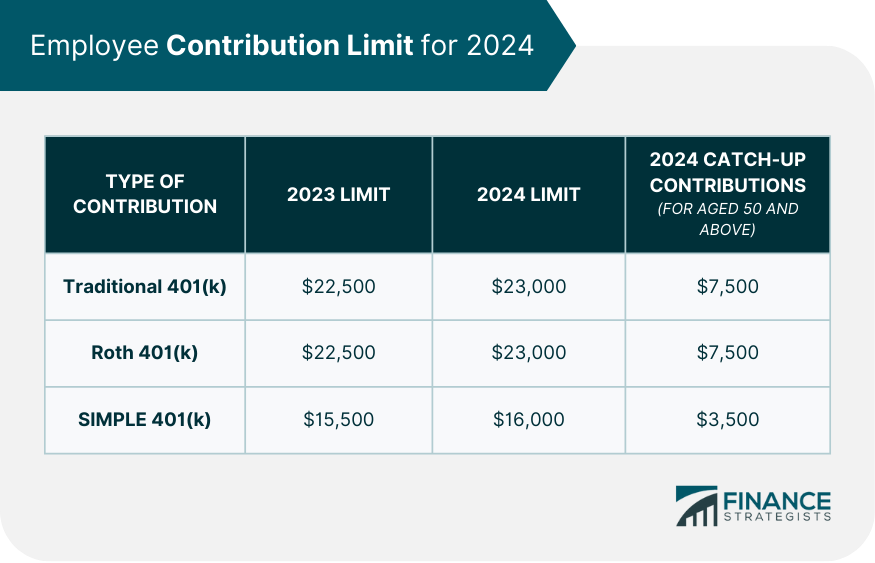

Maximum 401(k) Contribution for 2025 Finance Strategists, The contribution limit will increase from $22,500 in 2025 to $23,000. Log in to your principal account to check.

401k 2025 Contribution Limit Chart, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. Good news for 401 (k) and roth ira account owners:

maximum employer contribution to 401k 2025 Choosing Your Gold IRA, We can help you set up your own retirement savings with an ira or. Your contributions also can’t exceed 100% of your total salary.

401(k) Contribution Limits & How to Max Out the BP Employee Savings, Max contribution by state 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. The irs raised the standard 401 (k) contribution.

401(k) Contribution Limits in 2025 Meld Financial, Your contributions also can’t exceed 100% of your total salary. We can help you set up your own retirement savings with an ira or.

The Maximum 401(k) Contribution Limit For 2025, 2025 health savings account (hsa) contribution. Employees will be able to sock away more money into their 401 (k)s next year.

401(k) Contribution Limits for 2025 Discover the Maximum Amount You, 2025 health savings account (hsa) contribution. This is again up from $66,000 in 2025.

The Maximum 401k Contribution Limit Financial Samurai, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. Mega backdoor roth contribution limits.

In 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.