Home Business Tax Deductions 2025

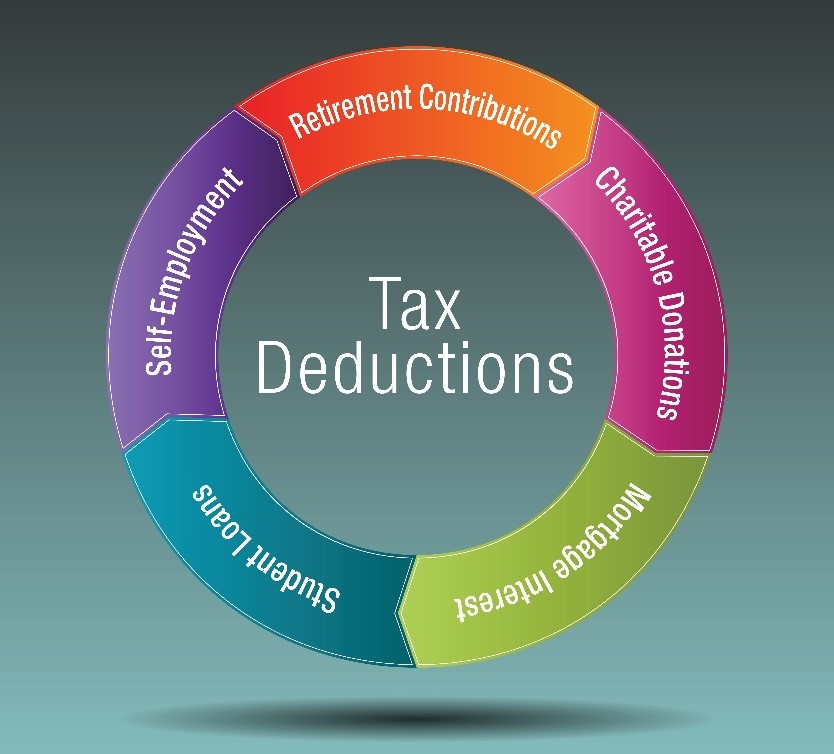

Home Business Tax Deductions 2025. Business tax deductions fit into specific reporting categories, like home office expenses, advertising, business travel expenses, and more. A credit cuts your tax bill.

This blog post will cover the top 7 small. It’s important to understand which expenses you can deduct in 2025 and how to calculate the deduction accurately.

This section discusses the depreciation and section 179 deductions you may be entitled to take for furniture and equipment you use in your home for business.

Pin on Save money with us The Financial Gym, The home office tax deduction allows qualifying taxpayers to deduct certain expenses related to their home office on their tax return. Business tax deductions fit into specific reporting categories, like home office expenses, advertising, business travel expenses, and more.

Home Business Tax Deductions Keep What You Earn (eBook) Business tax, Top tax deductions for small business. In this guide, we'll walk you through the biggest deductions you could be taking advantage of to lower your taxes owed and put money back into your pocket.

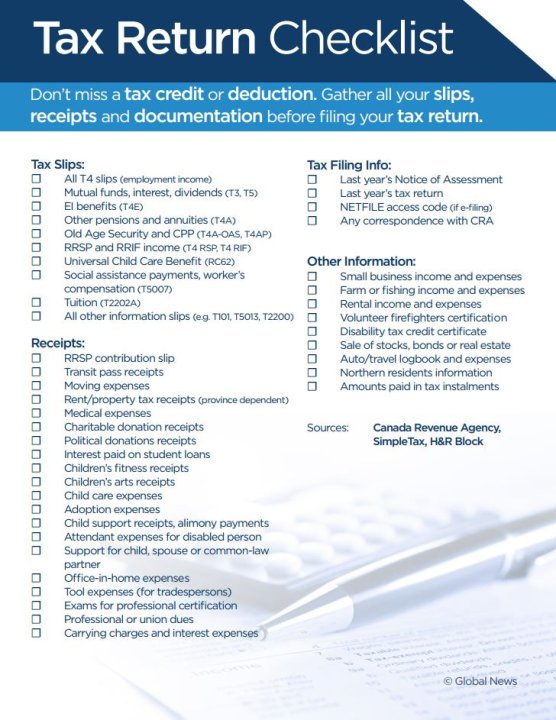

Filing your tax return? Don’t these credits, deductions, Business tax deductions fit into specific reporting categories, like home office expenses, advertising, business travel expenses, and more. A deduction cuts the income you're taxed on, which can mean a lower bill.

Tax Planning Strategies Tips, Steps, Resources for Planning, In this article, we’ll reveal the eligible expenses and provide. This blog post will cover the top 7 small.

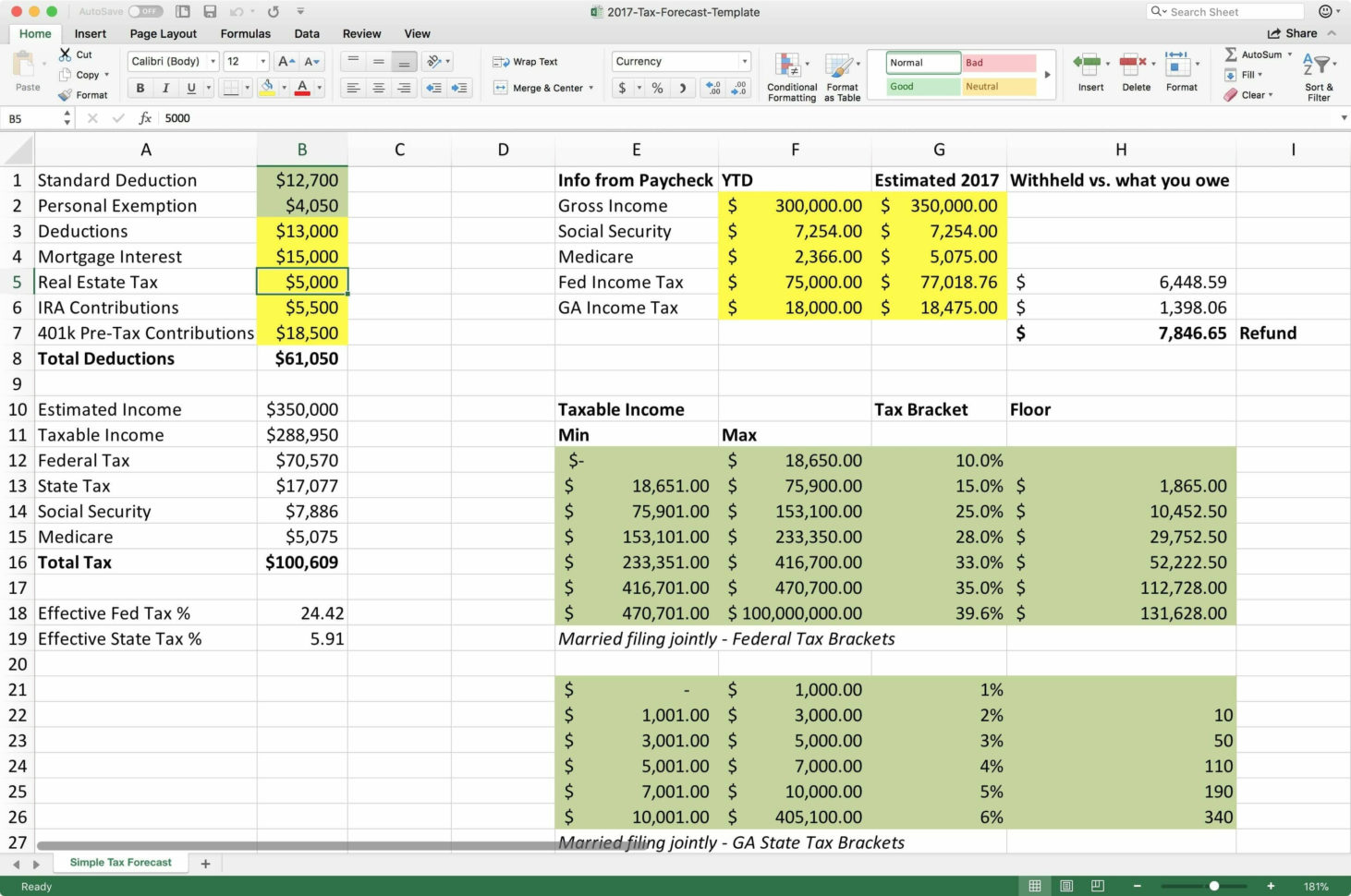

Tax Return Spreadsheet Template Spreadsheets, The home office tax deduction allows qualifying taxpayers to deduct certain expenses related to their home office on their tax return. Top tax deductions for small business.

Why the new tax regime has few takers, It’s important to understand which expenses you can deduct in 2025 and how to calculate the deduction accurately. Take advantage of the tax deductions available to help lower your taxable income and decrease your tax obligations.

What about home business tax deductions, It’s important to understand which expenses you can deduct in 2025 and how to calculate the deduction accurately. The home office tax deduction allows qualifying taxpayers to deduct certain expenses related to their home office on their tax return.

Itemized Deductions Still Exist for 2018 Tax Return!, The following are some of the tax changes for 2025. In this article, we’ll reveal the eligible expenses and provide.

Business Entertaining In Home Tax Deduction, Deductions are based on the percentage of your home devoted to business use, which you can determine by dividing the square footage of your office space by total. It’s important to understand which expenses you can deduct in 2025 and how to calculate the deduction accurately.

The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business, For information on other changes, go to irs.gov. This blog post will cover the top 7 small.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business](https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg)