Us Tax Brackets 2025 Married Filing Jointly

Us Tax Brackets 2025 Married Filing Jointly. Tax bracket tax rate ; For individuals, that rate kicks in at $626,350.

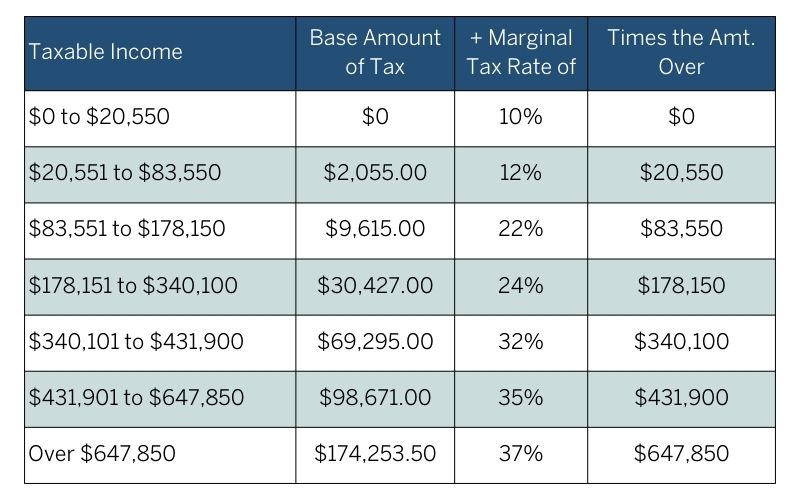

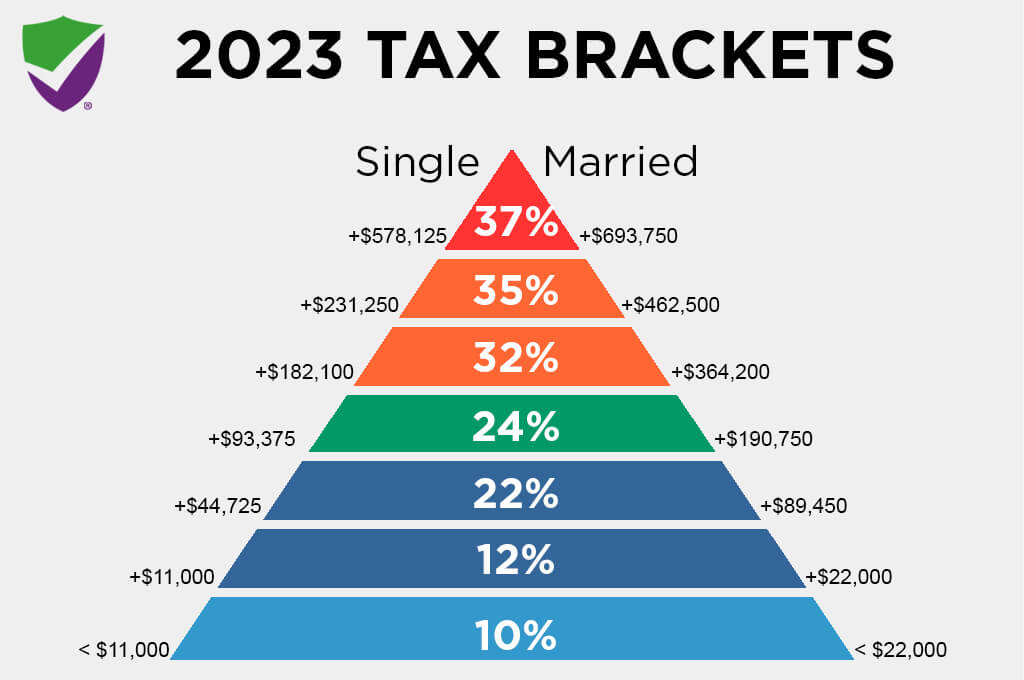

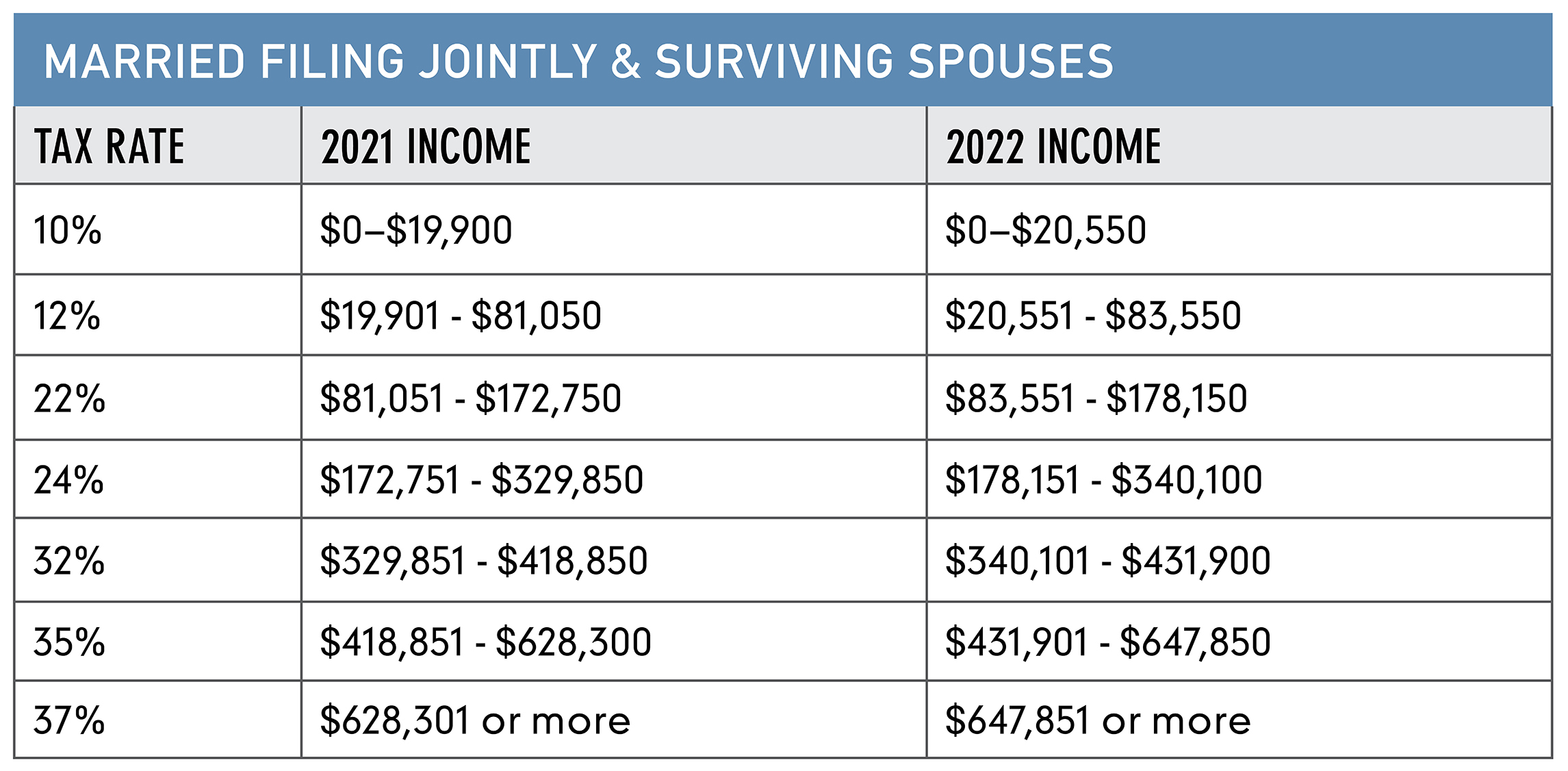

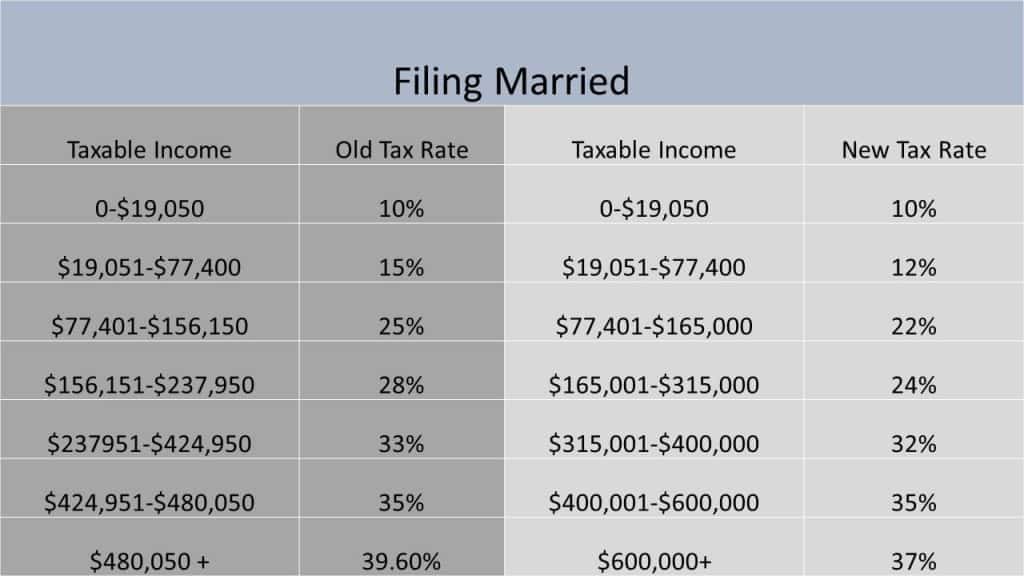

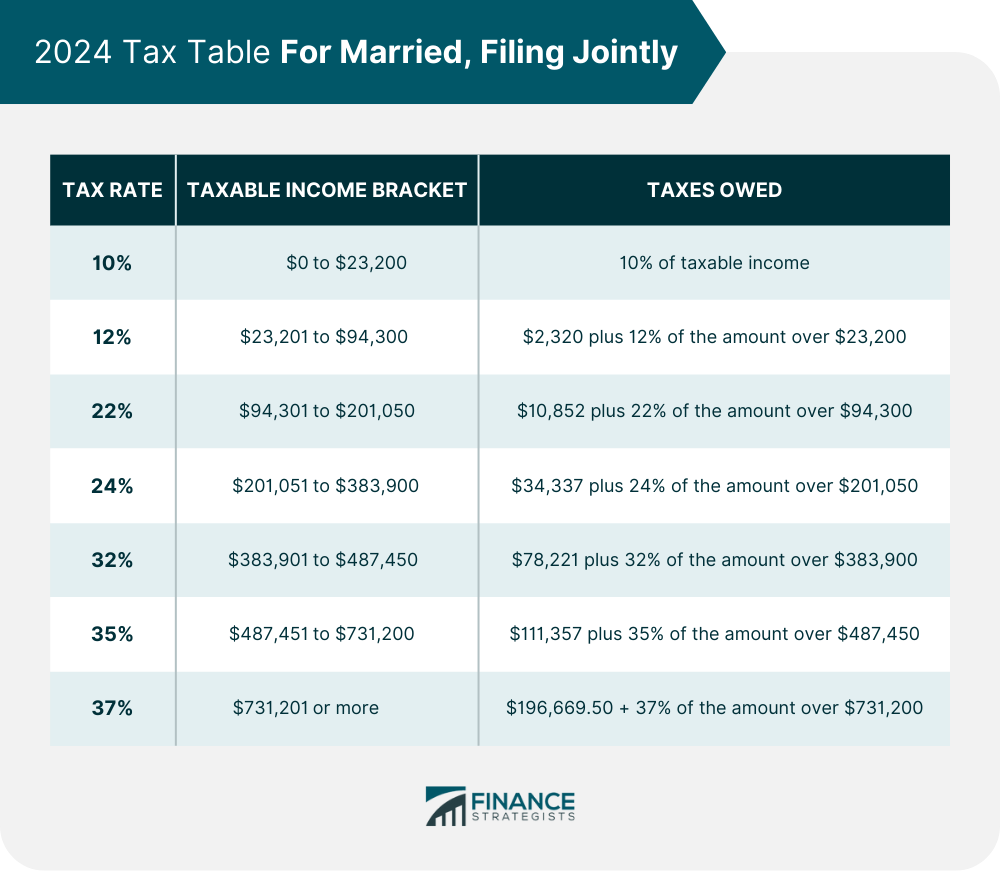

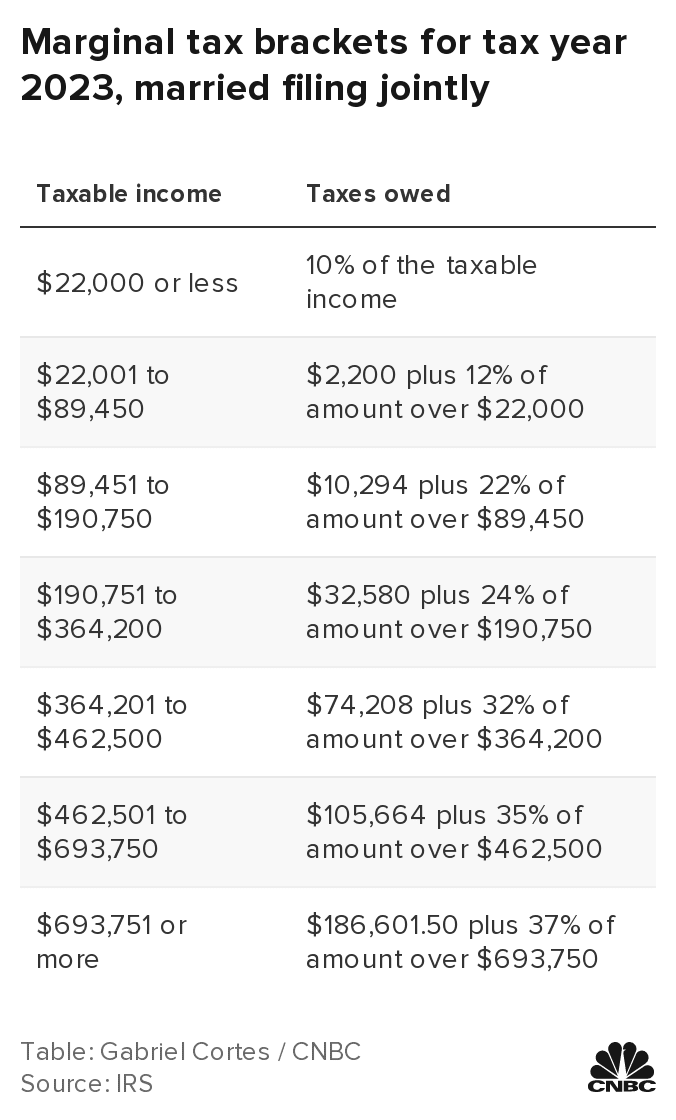

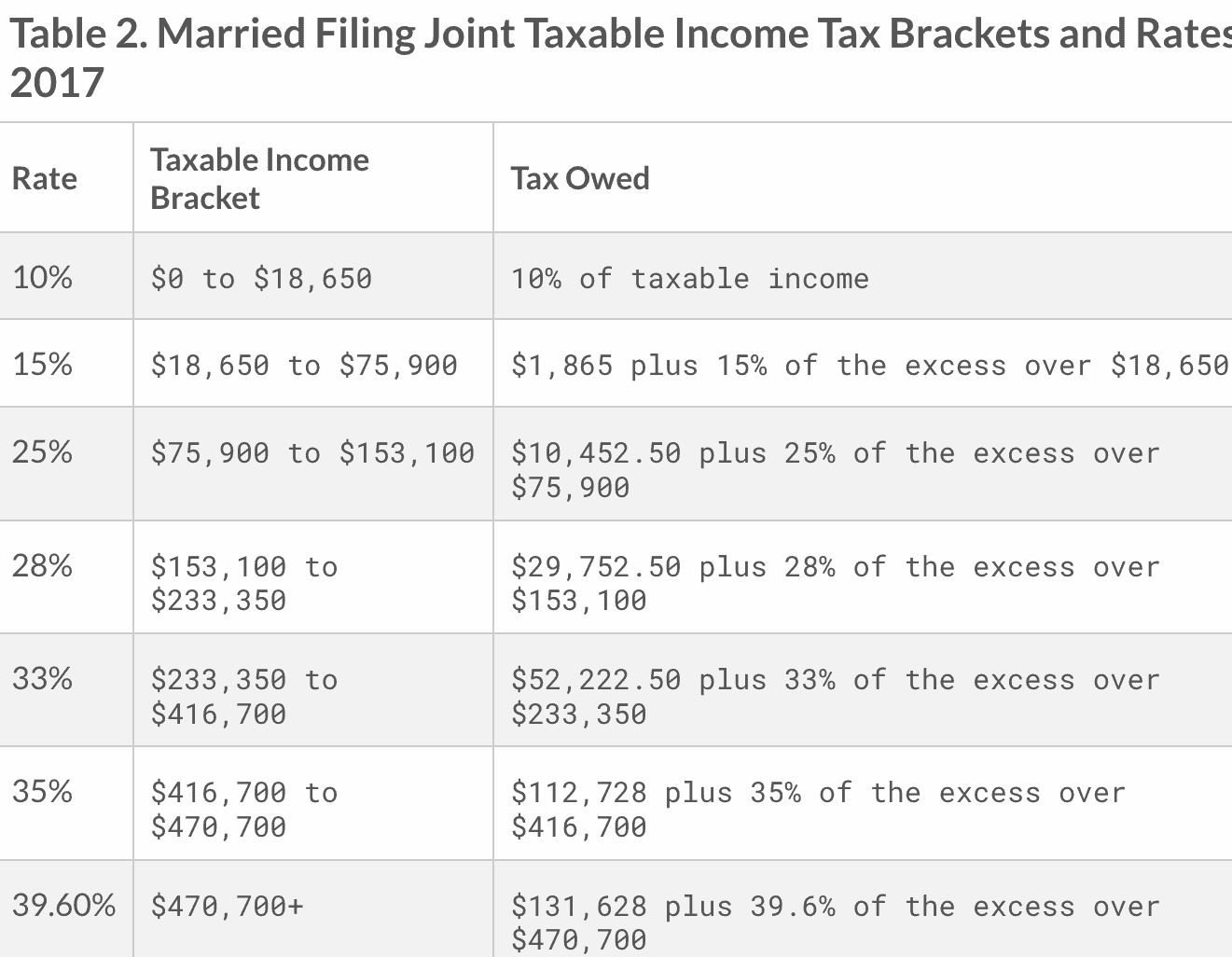

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Single, married filing jointly, married filing separately, or head of household.

Us Tax Bands For 2025 Married Jointly Meggy Malynda, The missouri tax brackets on this page sourced.

2025 Tax Brackets Married Filing Separately Calculator Basia Carmina, Publication 17 (2025), your federal income tax

Irs 2025 Tax Tables Married Jointly Irina Leonora, For example, if you’re married filing jointly for 2025 taxes with a taxable income of $95,000, you’d fall under the 22% tax bracket even though a majority of your taxable income ($94,300) falls under the 12% tax bracket.

Tax Brackets Definition, Types, How They Work, 2025 Rates, The table below shows the tax bracket/rate for each income level:

2025 Tax Brackets Married Filing Jointly With Dependents Bonni Christi, Single, head of household, married filing jointly, married filing separately, and qualifying widow (er).

Us Tax Brackets 2025 Married Jointly Single Edy Joelly, Your bracket depends on your taxable income and filing status.

Us Tax Brackets 2025 Married Filing Jointly Calla Corenda, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years.

Tax Bracket 2025 Usa Married Jointly Rebe Valery, This allows married couples to combine their income and deductions and file a single tax return.

Capital Gains Tax 2025 Married Filing Jointly With Spouse Aura Margie, There are five main filing statuses: